Empowering trading community with Transparency Performance Expertise Customer Support

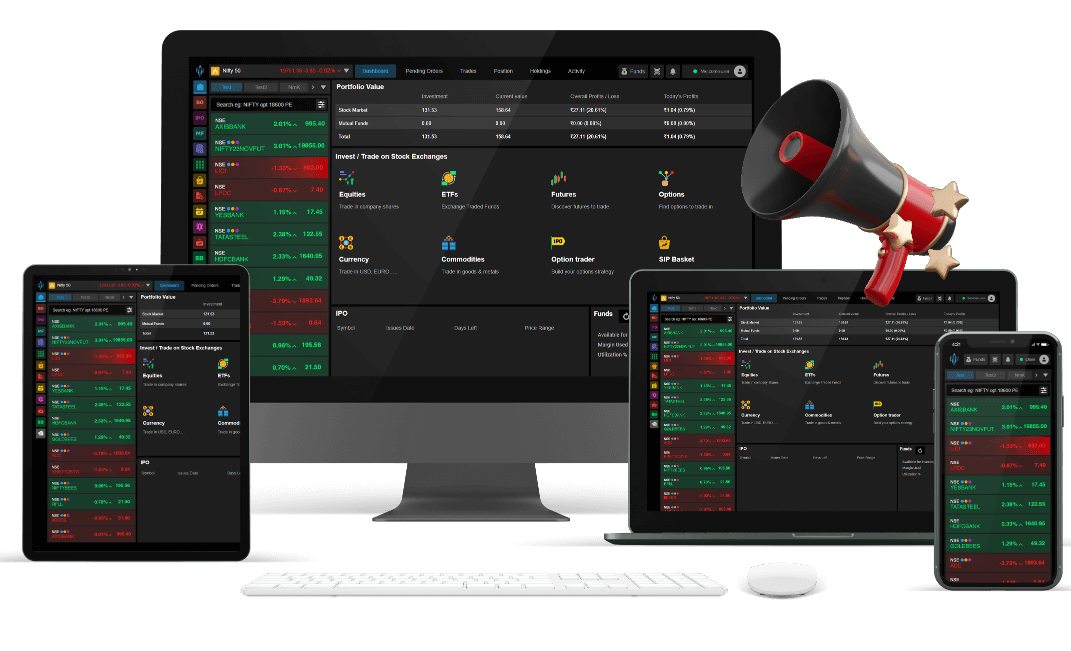

TRADE TODAY SMARTER FASTER SECURE

Discover the Next generation of innovation and invest in Stocks Derivatives Options Commodities ETFs NFOs IPOs Mutual Funds

PICK YOUR PREFERRED INVESTMENT

Equity

Equity represents ownership in a company, shown by shares held by investors. Shareholders benefit from dividends and stock price appreciation, sharing in profits and growth.

Derivative

Derivatives are financial contracts whose value depends on an underlying asset, like stocks, bonds, or commodities. Common types include options and futures.

Currency

Currency is a system of money used as a medium of exchange, typically issued by governments. Exchange rates allow conversion between currencies, influenced by factors like inflation, interest rates, and economic stability.

Commmodity

A commodity is a basic good used in trade, interchangeable with others of the same type, like Gold, Silver, Crude, Copper or Naturals. Prices are determined by supply and demand in global markets.

mutual Fund

A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professionals, it allows investors to access a wide range of assets with lower risk.

IPO

An IPO, or Initial Public Offering, is when a private company offers its shares to the public for the first time to raise capital. This process turns the company into a publicly traded entity, allowing investors to buy shares and potentially benefit from its growth and profits.

ETFs

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, much like stocks. They hold a diversified portfolio of assets (stocks, bonds, commodities) and provide investors with low-cost access to various markets.

NFO

A New Fund Offer (NFO) is the initial launch of a mutual fund by an asset management company (AMC), allowing investors to purchase units at a fixed price, typically ₹10 per unit. This phase enables the fund to gather capital for investing in securities like stocks, bonds, or other assets, aligning with its investment objectives.

Why we are your ideal investment partner?

PCJ HOLDINGS PVT. LTD. ( Formerly known As ADG SECURITIES PVT. LTD. ) was incorporated in year 2007. Since then it has come a long way. the management has good reputation in the broking industry. Our Managing director Phool Chand Jain ( Popularly known as P.C. Jain ) has been in the industry for last 32 years. Mr. P.C. Jain has a rich experience in the financial market and has astute knowledge of the industry. P.C. Jain the managing director of the PCJ HOLDINGS PVT. LTD. is very well known for his honesty and integrity in the industry.

GET STARTED

Start your Trading and Investing journey with just few clicks

our clients loves us

Contact Us

PCJ has corporate membership with National Stock Exchange of India Ltd. (NSE), Bombay Stock Exchange Ltd. (BSE), Multi Commodity Exchange of India Ltd (MCX) and National Securities Depository Limited. (NSDL)

Registered Office

Address: 803, Nirmal Tower, Barakhamba Road, Connaught Place, New Delhi - 110 001.

Phone: 011 - 4351 2500 To 04

Fax: 011 - 4707 2626

Email:[email protected]

Investor Grivences: [email protected]

Compliance Officer

Mr. Phool Chand Jain

Address:803, Nirmal Tower, Barakhamba Road Connaught Place, New Delhi - 110 001.

Phone: 011 - 4351 2500

Email:[email protected]

Call & trade

(9:00 am – 5:00 pm)

Call in for placing trades or modifyingpending orders.

011 43512500

011 43512501

Support related queries

(9:00 am – 5:00 pm)

Call in for technical support and to access your account information

011 43512502

011 43512503

Account opening & related queries

(9:00 am – 5:00 pm)

Call in to know more about our services, and for opening a new account

011 43512504

011 43512506

ATTENTION INVESTORS :

- KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (Broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

- For Stock Broking Transaction ‘Prevent unauthorised transactions in your account – update your mobile numbers/email IDs with your stockbrokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day.

- For Depository Transaction ‘Prevent Unauthorized Transactions in your demat account – Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from CDSL/NSDL on the same day.

- If you are subscribing to an IPO, there is no need to issue cheques. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.

- Investors should be cautious on unsolicited emails and SMS advising to buy, sell or hold securities and trade only on the basis of informed decision. Investors are advised to invest after conducting appropriate analysis of respective companies and not to blindly follow unfounded rumours, tips etc. Further, you are also requested to share your knowledge or evidence of systemic wrongdoing, potential frauds or unethical behaviour through the anonymous portal facility provided on BSE & NSE website.

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment.

- Investors may please refer to the Exchange’s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard.

Risk disclosures on Derivatives :

- 9 out of 10 individual traders in equity Futures and Options Segment, incurred net losses.

- On an average, loss makers registered net trading loss close to ₹ 50,000.

- Over and above the net trading losses incurred, loss makers expended an additional 28% of net trading losses as transaction costs.

- Those making net trading profits, incurred between 15% to 50% of such profits as transaction cost

Advisory For Investors :

- Ensure that pay-out of funds/securities is received in your account within 1 working day from the date of pay-out.

- Register for online applications viz Speed-e and Easiest provided by Depositories for online delivery of securities as an alternative to DDPI/POA.

- Ensure that you receive Contract Notes within 24 hours of your trades and Statement of Account at least once in a quarter from your Stock Broker.

- If you have opted for running account, please ensure that the stock broker settles your account regularly and in any case not later than 90 days (or 30 days if you have opted for 30 days settlement).

- Do not keep funds idle with the Stock Broker.

- Regularly login into your account to verify balances and verify the demat statement received from depositories for correctness.

- Check messages sent by Exchanges on a monthly basis regarding funds and securities balances reported by the trading member and immediately raise a concern if you notice a discrepancy.

- Always keep your contact details viz Mobile number / Email ID updated with the stock broker. You may take up the matter with Stock Broker / Exchange if you are not receiving the messages from Exchange / Depositories regularly.

- If you observe any discrepancies in your account or settlements, immediately take up the same with your stock broker and if the Stock Broker does not respond, with the Exchange/Depositories.

- Beware of fixed/guaranteed/regular returns/ capital protection schemes. Brokers or their authorized persons or any of their associates are not authorized to offer fixed/guaranteed/regular returns/ capital protection on your investment or authorized to enter into any loan agreement with you to pay interest on the funds offered by you. Please note that in case of default of a member claim for funds or securities given to the broker under any arrangement/ agreement of indicative return will not be accepted by the relevant Committee of the Exchange as per the approved norms.

- Please do not transfer funds, for the purposes of trading to anyone, including an authorized person or an associate of the broker, other than a SEBI registered Stock broker.

As per advisory issued by exchanges, while dealing in options, clients/investors shall avoid the following :

- Sharing of trading credentials – login id & passwords including OTP’s.

- Trading in leveraged products like options without proper understanding, which could lead to losses.

- Writing/ selling options or trading in option strategies based on tips, without basic knowledge & understanding of the product and its risks.

- Dealing in unsolicited tips through WhatsApp, Telegram, YouTube, Facebook, SMS, calls, etc.

- Trading in “Options” based on recommendations from unauthorized / unregistered investment advisors and influencers.

Awareness regarding guidelines of margin collection :

1)Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w.e.f September 01, 2020.

2)Update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge.

3)Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

Issued in the interest of investors

Disclosure

Dear Investor / Client, Under instruction of SEBI, The National Stock Exchange of India Ltd. (NSE), Bombay Stock Exchange Ltd. (BSE), Multi Commodity Exchange of India Ltd (MCX) has directed all its members to inform their clients whether they engage in proprietary trading in this regard we wish to inform you that we as a company do engage in proprietary Business in the National Stock Exchange of India Ltd. / Bombay Stock Exchange Ltd / Multi Commodity Exchange of India Ltd.

Procedure for filling the compliant

If there is any compliant / grievances of any client, the client may file their compliant to us through a mail to the mail id of the compliance officer “[email protected]”. The client may also file their compliant as per the details available in escalation matrix on the website. Our dedicated compliance team will verify the compliant and take the necessary action of the same.

We invite you to fully experience, enjoy and participate in the many unique services and features offered on PCJ Holdings (P) Ltd. However, the use of the website is offered to you on your acceptance of the Terms of Use, our Privacy Policy and other notices posted on this website. Your use of this website or of any content presented in any and all areas of the website indicates your acknowledgment and agreement to these Terms of Use, our Privacy Policy and other notices posted on this website.

PCJ Holdings (P) Ltd also reserve the right at its sole discretion, to modify, add or remove any terms or conditions of these Terms of Use without notice or liability to you. Any changes to these Terms of Use shall be effective immediately, following the posting of such changes on this website. Your continued use of pcjholdings.in means that you accept any new or modified terms and conditions that are maintained. We would thus encourage you to re-visit the ‘Terms of Use’ link at our site from time to time to stay abreast of any changes that are introduced.

No disclaimer by the ITORS Member, shall state anything contrary to the provisions of the Model Agreement or the liabilities/responsibilities imposed on the ITORS Member by the Rules, Bye-laws and Regulations, procedures and notices of the Exchange, Rules, Regulations and Circulars of SEBI and any other law for the time being in force.

The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc., of any of the Rules, Regulations, Bye-laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time.

The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us.